Picture this: It’s December 15th, and you suddenly remember you haven’t bought a single Christmas gift. Your stomach drops as you realize you’ll either have to max out your credit card or raid your emergency fund. Sound familiar?

If you’ve ever felt that pit-in-your-stomach panic when an “unexpected” expense hits, you’re not alone. I used to live in a cycle of financial stress until I discovered a straightforward strategy that changed everything: setting up sinking funds.

Ever get hit with an expense you knew was coming, but still weren’t prepared for? Like your car registration, Christmas gifts, or your kid’s birthday party? That used to be me-until I discovered sinking funds. Once I started using them, everything changed.

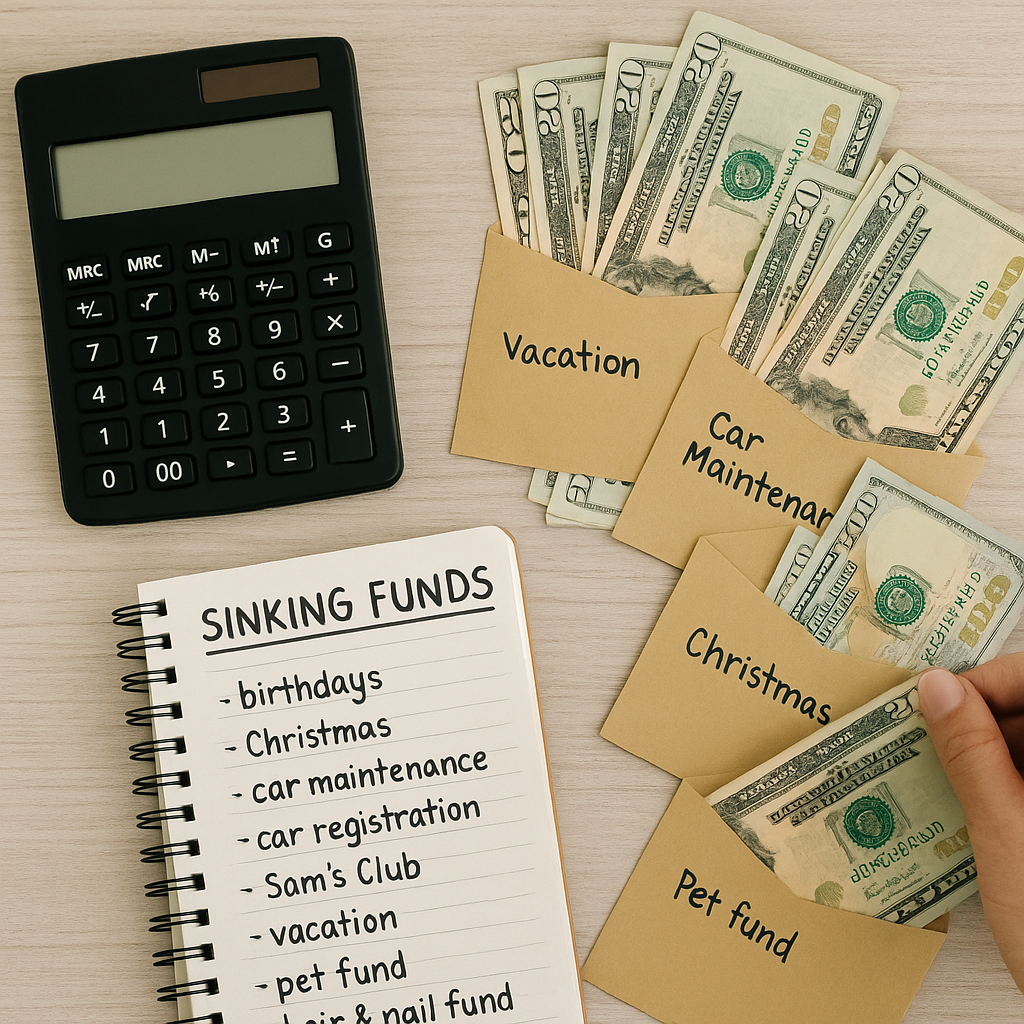

Sinking funds are like little budget lifesavers. Instead of scrambling or pulling out the credit card, I set aside small amounts throughout the year for things I know will come up. Whether it’s saving for a family vacation or keeping up with car maintenance, my sinking funds help me stay prepared, less stressed, and in control of my finances. In this guide, I’m walking you through exactly what sinking funds are, how I use them, and how they can completely transform the way you handle money. Let’s dive in.

What is a Sinking Fund?

A sinking fund is a straightforward savings strategy in which you regularly set aside money for specific, anticipated expenses. Unlike a general savings account, which accumulates cash for any purpose, a sinking fund has a particular goal. It’s for something specific—like Christmas shopping, birthdays, a car registration renewal, or even a yearly Sam’s Club membership.

I think of it like breaking big bills into smaller, manageable chunks. For example, if I know Christmas gifts will cost me around $600, I start saving in January by setting aside $50 each month. That way, when December rolls around, I’m ready.

It also helps avoid the temptation to dip into your emergency fund or swipe your credit card for things you could have planned for in advance. It’s about being intentional and giving your money a purpose, one category at a time.

Now that you understand what a sinking fund is, let’s talk about why this simple concept can revolutionize your entire approach to money management.

The Importance of Sinking Funds in Financial Planning

Sinking funds are now one of the most important tools in my financial planning. They’ve helped me stay consistent, focused, and calm even when life throws surprises my way.

The biggest win? They reduce my financial stress. When my car needs an oil change or my kids’ birthdays sneak up on me, I’m not panicking. I already have a stash ready because I’ve been setting aside a little bit each month. Whether it’s a $100 dentist co-pay or new tires, I’ve got peace of mind knowing I planned ahead.

On top of that, it helps me build better habits. Saving regularly for things like hair appointments or pet care helps me stay disciplined. It’s become second nature to plan, and that mindset has spilled over into other areas of my financial life.

Ready to experience this financial peace for yourself? Let me walk you through exactly how to get started.

How to Set Up a Sinking Fund

Getting started with sinking funds is super easy, and once you do it, you’ll wonder why you didn’t start sooner. First, list out all the things that pop up throughout the year that you always forget to budget for. For me, that’s birthdays, Christmas, car maintenance, car registration, Sam’s Club membership, and even a vacation fund.

Once I have those categories, I decide how much I’ll need and by when. Say I want $500 for a family trip next summer, and I have 10 months to save, that’s $50 a month. Then I either use a separate savings account or cash envelopes labeled for each goal.

I also automate some of my transfers, so I don’t even have to think about it. That consistency makes it easy, and the best part is knowing I won’t be caught off guard when the expense rolls around.

When planning your sinking funds, it’s helpful to think about them in terms of timing. This brings us to an important distinction between short-term and long-term goals.

Types of Sinking Funds

You can break your sinking funds into two categories: short-term and long-term. Short-term sinking funds are for expenses you know will occur within the year, such as birthdays, Christmas, car maintenance, or renewing your membership. I’ve got separate funds for each of those because they’re always coming up.

Long-term sinking funds are for bigger goals that take more time. Currently, I’m slowly building a vacation fund and one for future dental procedures that may not occur this year, but will likely happen down the line. These take longer to fill, but because I’m planning ahead, I’m never behind.

Having both types gives me peace of mind now and in the future. I can enjoy the holidays without financial stress and save toward something fun or necessary in the future, such as braces or a big family trip.

Once you’ve identified the funds you need, the next step is to determine precisely how much to save each month. Here’s my simple approach to the math.

Calculating Your Sinking Fund Contributions

Once I know how much I need for a specific fund, I do some simple math. Say I need $600 for Christmas and I’ve got 12 months, boom, $50 a month. Or, if my Sam’s Club membership costs $110 per year, I save about $9 a month.

I also break things down by paycheck if that’s easier for you. For example, I receive bi-weekly paychecks, allowing me to set aside $25 every two weeks for Christmas or $20 per check for car maintenance. This makes everything feel super doable.

And if I get extra money, like a bonus, a tax refund, or even cash back, I might throw that into one of my sinking funds to get ahead. I also check in every couple of months to see if I need to make any adjustments.

Wondering what specific categories you should consider? Here are the most popular sinking funds that have made the most significant difference in my life.

Common Uses for Sinking Funds

There’s no limit to what you can use a sinking fund for; it’s all about what you need to plan for. Some of the most common ones I use are:

- Birthdays and holidays – These come every year, yet they always used to sneak up on me.

- Car maintenance and registration – Oil changes, tire replacements, or those yearly DMV fees.

- Sam’s Club membership – Only once a year, but I treat it like a bill and plan.

- Vacation fund – Even if it’s a quick weekend trip, I want to enjoy it without financial guilt.

- Pet care – Our pets need love (and vet visits), so I keep a little saved for their needs.

- Dental fund – I’ve got insurance, but it doesn’t cover everything, so this helps with co-pays.

- Hair & nails – Yes, this counts too! It’s self-care and part of my monthly routine.

All of these used to throw off my budget, but not anymore. Planning for them keeps me in control.

Before we dive deeper into managing your funds, let’s address a common misconception I often hear.

Common Mistakes to Avoid with Sinking Funds

Even with the best intentions, I’ve seen people (including myself!) make some common mistakes when starting with sinking funds. Here are the biggest ones to watch out for:

Starting too big, too fast. Don’t try to create 15 different sinking funds right away. Start with 2-3 categories that stress you out the most, then add more as the habit becomes natural.

Being too rigid with amounts. Life happens, and sometimes you can’t contribute the full amount. I’d rather you save $20 instead of your planned $50 than skip the month entirely. Consistency beats perfection.

Forgetting to adjust for inflation. That Christmas fund that worked perfectly last year? You might need to bump it up a bit this year. I review my amounts every six months.

Using sinking funds as an excuse to overspend. Just because you have a vacation fund doesn’t mean you should book the most expensive trip possible. Stick to reasonable budgets.

Not celebrating the wins. When you successfully use a sinking fund instead of going into debt, take a moment to appreciate that victory! It reinforces the positive habit you’re building.

The key is to learn from these mistakes and adjust your approach. Remember, you’re building a system that works for your life, not following someone else’s perfect plan.

Sinking Funds vs. Emergency Funds

It’s important to know that sinking funds and emergency funds aren’t the same thing. Your emergency fund is there for the unexpected—like losing your job, a medical emergency, or a major home repair. It’s your financial safety net.

Sinking funds, on the other hand, are for the things you know are coming. You may not know exactly when, but you know they’re on the horizon. For example, I might not know when my car battery will die, but I know it will eventually run out of power. That’s where the car maintenance fund steps in.

Having both means I’m covered for surprises and the expected. And that combo is what keeps my finances steady.

Now that you know the difference between these two types of savings, let me share some practical tips I’ve learned for keeping your sinking funds on track.

Tips for Managing Your Sinking Fund Effectively

Here’s what’s worked best for me when managing my sinking funds:

Keep it separate. Whether it’s a separate savings account or cash envelopes, make sure you don’t mix sinking fund money with your regular spending money.

Automate when possible. I love setting it and forgetting it. Automating transfers takes one more thing off my plate.

Be flexible. Life happens. Sometimes I have to pause or lower a contribution. And that’s okay! The key is staying consistent over time.

Track your progress. I love seeing my vacation fund grow or reaching my goal before Christmas arrives. It keeps me motivated and proud of the progress I’m making.

It doesn’t have to be perfect. It just has to work for you.

Real-life Examples of Sinking Funds in Action

Here’s what it looks like in real life: A few months ago, my son’s birthday was coming up and I already had the money saved. No stress, no last-minute hustle; I just pulled from the birthday fund and celebrated.

When my car needed new tires last year, I was able to pay in full with my car maintenance fund. No credit cards. No panic.

And one of my favorite examples is our family vacation. Because I’d been putting aside a little each month, we went on a trip completely guilt-free. I didn’t worry about the hotel, food, or activities. We just enjoyed it—and that’s what financial freedom feels like.

Making Sinking Funds Work for You

Sinking funds have completely transformed how I handle money, and I know they can do the same for you. They’re simple, flexible, and honestly, one of the most life-changing financial tools you’ll ever use. No more financial panic, no more credit card debt for things you could have planned for.

Here’s my challenge for you: Pick just one category that always catches you off guard. Maybe it’s Christmas gifts, car maintenance, or birthdays. Calculate how much you need and start setting aside that money this month. Even if it’s just $10 or $20, you’re building the habit that will change your financial future.

Ready to take your budgeting to the next level? Join my newsletter for weekly money tips, free budgeting templates, and real-life strategies that actually work. I share the behind-the-scenes of my own financial journey, including the mistakes I’ve made and the wins I’ve celebrated. Plus, you’ll get my free “Sinking Fund Starter Kit” with printable trackers to help you get organized right away.

Don’t let another “surprise” expense catch you off guard. Start your sinking fund journey today, and experience the peace of mind that comes with being financially prepared.

Frequently Asked Questions About Sinking Funds

Q: How many sinking funds should I have? A: Start small! I recommend beginning with 2-3 funds for expenses that stress you out the most. You can always add more categories as the habit becomes natural. Most people successfully manage 5-8 different sinking funds.

Q: Should I keep sinking funds in separate bank accounts? A: It depends on your preference! I use a combination – some in high-yield savings accounts and others in cash envelopes. The key is to keep the money separate from your regular spending, so you’re not tempted to use it for other purposes.

Q: What if I can’t afford to contribute to all my sinking funds every month? A: That’s normal! Prioritize the most urgent or stressful categories first. Even saving $5-10 per month is better than nothing. You can adjust amounts based on your current financial situation.

Q: Can I use sinking fund money for emergencies? A: Only as a last resort! Sinking funds are for planned expenses, while emergency funds are for true unexpected events. If you must borrow from a sinking fund, make sure to replenish it as soon as possible.

Q: How do I know how much to save for each category? A: Look at last year’s expenses as a starting point. For new categories, research average costs or make your best estimate. You can always adjust amounts after a few months of tracking your actual spending.

Q: What’s the difference between a sinking fund and just saving money? A: Sinking funds have specific purposes and timelines, while general savings can be used for anything. This targeted approach helps you avoid spending the money on other things and ensures you’re prepared for specific expenses.

Q: Should I pause sinking fund contributions to pay off debt? A: Focus on high-interest debt first, but try to maintain small contributions to your most essential sinking funds (like car maintenance). This prevents you from going further into debt when those expenses arise.

Ready to Get Organized? Here Are My Favorite Tools

Managing multiple sinking funds is so much easier when you have the right system. Here are the tools that have made all the difference in my sinking fund success:

For Cash Envelope Users:

- The Budget Mom’s Cash Envelopes – These are hands-down my favorite! They’re durable, clearly labeled, and perfect for organizing different sinking fund categories. I love how they help me physically separate my money and stay accountable.

For Digital Organization:

- Custom Etsy Envelope Systems – If you prefer a more personalized approach, I absolutely love the custom envelope sets I found on Etsy. You can get them labeled with your specific sinking fund categories, and they’re beautiful enough that you’ll actually want to use them.

Both options help you keep your sinking fund money separate from your everyday spending cash, which is crucial for success. Choose the system that feels right for your lifestyle – the best budget tool is the one you’ll actually use!